What’s Your Definition of Wealth?

I can't believe it, next January I'll be able to say I’ve been in the finance industry for 2 decades!! Woah 😳 that's a long time, and it makes me feel super old! I did start as a baby though, so lets keep that in mind ;)

Over these years I've gained substantial knowledge in financial management, and, these things have always remained; My integrity and dedication to clients and the relationships we build together are #1, fuelled with my passion for investment planning and providing financial education so my clients feel empowered and in control of their financial life, so they can feel free, and live the life they love!

What does wealth mean to you?

I’ll share mine as money is only a piece of the wealth pie, it plays a large role in my life and is used as a tool to help me (and help my girls) reach our goals, but true wealth isn't only monetary in my mind. It's feeling fulfilled from the inside out, it’s overall happiness and contentment in life, and enjoying more of the small moments we can easily take for granted. Its feeling grateful for our life and taking an extra beat in a fleeting moment. Its catching those moments being so in alignment with who we are that our heart and soul radiates energy that is magnetic and attracts all the synchronies and blessings into our life. It’s living outside our comfort zone and riding the edges of our heart so we can continue to expand into who we are. Wealthy is feeling fulfilled from the inside out.

Has your self worth been tied to your career, and security to money?

A question not typically asked or understood due to the vulnerability of it.

I wouldn't of questioned it until I started digging deep and realizing some of mine was...

Here’s some things I learned about wealth, and my career status when I decided to take a step away from my professional titles and being a “successful corporate woman”;

I’ve been in Finance for 19 years. I grew up in the corporate world and I very much adopted the mentality of excelling, performance, pushing myself and exceeding. I created this linear illusion of success that validated my power and worth. As long as I was climbing the corporate ladder and excelling I felt worthy. As long as I had money in my bank and investments with some zero’s behind it I felt like I was somebody. As long as I had initials behind my name representing different financial designations, and as long as I had a position of power I was strong and confident.

I tied a lot of my worth and who I was to my career, it became my identity. The money in my accounts was a form of security for me, albeit false, because no matter how much I had I never felt secure and was always operating in lack. I inadvertently built my worth and my security outside of myself, and it was conditional on how much I achieved.

It took intentional healing and slowing down to confront this truth. It wasn’t pretty, I chose to deconstruct who I built myself to be. I let go of titles and who others thought I was, along with beliefs and behaviours that were no longer serving me. This is part of being human and living a life in alignment. When we start to ask the hard questions, we begin to heal and we start to demand better for our life. We stop making excuses, and begin to cultivate our own inner richness and power, building a life from the inside out, not outside in. We no longer try to fit in someone else’s definition of who they think we are and give ourselves permission to let go, and evolve into our next version of self.

“Measuring wealth by money alone is spiritually empty. To obtain wealth of lasting kind, the kind that gives your life value, meaning and sustenance, base your daily existence on your spirit and seek more out of life.” ~ Deepak Chopra, MD

Do you want to feel more empowered and knowledgeable with your finances, as well as learn to live an abundant life aligned to your inner richness and not reliant on your bank account? Have you resonated with my words?

Contact me to find out what that could look like for you.

We all need teammates, and I’d like to be yours.

Don’t walk, RUN! The market is on sale!

The S&P 500 has lost 15% of its value since the beginning of this year.

Market crash/correction sounds scary, when in reality, history has shown its just a blip on the radar long term;

I’m not discounting the fear, the fear is real and I’m here to say you are allowed to feel that, but do NOT let the media sway you, do not let friends talk you into changing ANYTHING! Do not talk to your neighbour and take their tips and make a move you will later regret. Do not move! Avoid emotional knee jerk reactions and filter out the noise to avoid mistakes. (See my earlier post around emotional investing)

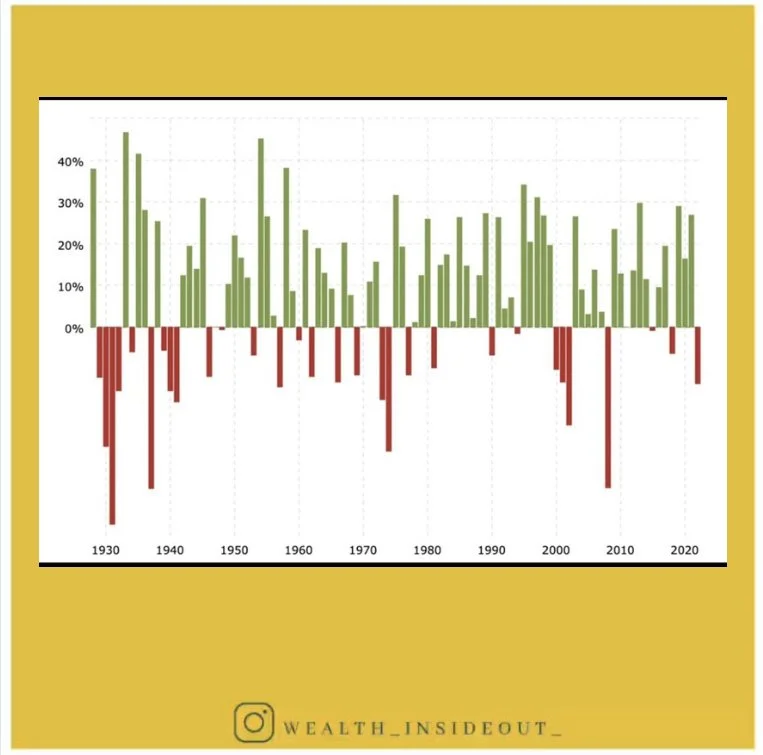

Market corrections are a normal part of investing. Since 1928, we've had 26 bear markets (decline) in the S&P 500, and 27 bull markets (incline). Gains during bull markets far outweigh the losses of bear markets.

Remember, we are playing the long game, (your money SHOULD NOT be in the market if it’s short term - it’s too risky!) and when investing for the long term this now provides you an opportunity to buy more shares at cheaper price to realize gains later.

Statistically, stocks lose an average of 36% in a bear market and gain an average of 114% in a bull market.

I read a great analogy today;

“When the shoes you love go on sale, we probably buy another pair in a different colour! We don’t try and sell our loved shoes at a discount”

Or how about this one;

“when you were dating in high school, and your partner broke up with you, At the time it’s devastating. 10 years later it’s pretty insignificant overall”

Bear markets can be an opportunity instead of panic! An opportunity to buy at a cheaper price.

If you are anxious and unsure this is the time having an advisor will pay dividends, reach out to them, or they should be reaching out to you to check in and smooth concerns. I went through the crash in 2008 with my clients, some unfortunately fear got the best of them, no matter what I had to say and they chose to cash in never recouping the loss, while the majority has a distant memory stayed invested for the long haul and reaped the rewards especially in 2013!

Albeit it was a bumpy, emotional and tremulous time for all involved - as an advisor we have our finger on the pulse, let us do what we do best.

You can refer to this graph for the bull (green) and bear (red) markets to show the history of the market and after a bear, always follows with a bull market to capitalize on.

Avoid Emotional Investing

People naturally tend to become emotionally invested in their own portfolios. They become overly greedy when markets are up and overly fearful when markets are down. The reasons for these attitudes are well documented by behavioural economics.

Having an Advisor keeps your emotions away from the investment process, amid all the volatility and unpredictability that markets show, the ultimate value of a planner is to keep you focused and in your seat. Focused more on your long term goals than the short term volatility of your portfolio. A really great article I read said, "A good Advisor will protect you, from you. No, your advisor can't stop you from feeling whatever emotions you're feeling, just like a guardrail can't stop every car from going into the ditch. In those moments where you want to push the eject button because you're scared, the advisor's job is to remind you of the plan you created and what you're working towards: "a fulfilling and successful retirement."

Good advisors help you navigate your emotions and coach you through choppy storms.

Isn't it also nice to have a partner for your journey to financial wholeness? Having someone in your corner who's as invested in your success as you are? I'm talking about an advisor who thoroughly knows you, your spouse, your kids, your dream job, your hopes and aspirations for your future. Someone who cares about you, knowing that your advisor truly has your best interest at heart is psychologically impactful. Just as people hire personal trainers or business coach's the advisor sets your up for success and roots for you every step along the way. If you don't have a connection with your advisor, I'd suggest you keep looking until you find one because they will make a world of difference.

Behavioural Study and Loss Aversion in Investing

It’s been a bumpy ride, I won’t deny that. Markets are volatile, the world is volatile.

Stay in your seat!

At this point in time I’d like to turn your attention to behavioural biases you may be consuming, and the instinctive human nature to loss aversion.

Are the messages you receive all doom and gloom? Are they from credible sources? How much attention are you giving to the negative and catastrophizing? Are you now only focused on short term vs. long term planning?

Again, this is not the time to do anything except lean on your advisor, or credible sources who understand how the market moves. Please see my blog post “Emotional Investing”

I met with a woman yesterday who wanted a second opinion on her portfolio because she “lost” quite a bit of money. Scrambling, experiencing many REAL and EXPECTED reactions to her financial statements, she wanted to pull all of it out to “stop the bleeding.”

Here’s also where loss aversion comes into play. Loss aversion in behavioral economics refers to a phenomenon where a real or potential loss is perceived by individuals as psychologically or emotionally more severe than an equivalent gain. For instance, the pain of losing $100 is often far greater than the joy gained in finding the same amount.

Sociologists point to the fact that we are socially conditioned to fear losing, in everything from monetary losses but also in competitive activities like sports and games to being rejected by a date. Or, fear that keeps you stuck in the same spot, I learned a lot about this in my Psychology and Neuroplasticity courses and its fascinating!

Investors can avoid psychological traps by adopting a strategic asset allocation strategy with their advisor, think rationally, and not let emotion get the better of them.

I want to remind you, that you do not lose until you cash it in! And, moving to a lower risk investment may slow the decline, but remember you will miss the incline! And, the incline WILL come. If you make a move now, you’ve lost. If you lower your risk it may look better in the short term, but not in the long term if we could extrapolate out.

Below is a graph of the bull (green) and bear (red) markets. Being an advisor in 2008 was treacherous, it WAS NOT a fun time. People did pull out at the bottom, against professional advice, please note the growth that proceeded the downturn.

Keep you bum in the seat!