Behavioural Study and Loss Aversion in Investing

It’s been a bumpy ride, I won’t deny that. Markets are volatile, the world is volatile.

Stay in your seat!

At this point in time I’d like to turn your attention to behavioural biases you may be consuming, and the instinctive human nature to loss aversion.

Are the messages you receive all doom and gloom? Are they from credible sources? How much attention are you giving to the negative and catastrophizing? Are you now only focused on short term vs. long term planning?

Again, this is not the time to do anything except lean on your advisor, or credible sources who understand how the market moves. Please see my blog post “Emotional Investing”

I met with a woman yesterday who wanted a second opinion on her portfolio because she “lost” quite a bit of money. Scrambling, experiencing many REAL and EXPECTED reactions to her financial statements, she wanted to pull all of it out to “stop the bleeding.”

Here’s also where loss aversion comes into play. Loss aversion in behavioral economics refers to a phenomenon where a real or potential loss is perceived by individuals as psychologically or emotionally more severe than an equivalent gain. For instance, the pain of losing $100 is often far greater than the joy gained in finding the same amount.

Sociologists point to the fact that we are socially conditioned to fear losing, in everything from monetary losses but also in competitive activities like sports and games to being rejected by a date. Or, fear that keeps you stuck in the same spot, I learned a lot about this in my Psychology and Neuroplasticity courses and its fascinating!

Investors can avoid psychological traps by adopting a strategic asset allocation strategy with their advisor, think rationally, and not let emotion get the better of them.

I want to remind you, that you do not lose until you cash it in! And, moving to a lower risk investment may slow the decline, but remember you will miss the incline! And, the incline WILL come. If you make a move now, you’ve lost. If you lower your risk it may look better in the short term, but not in the long term if we could extrapolate out.

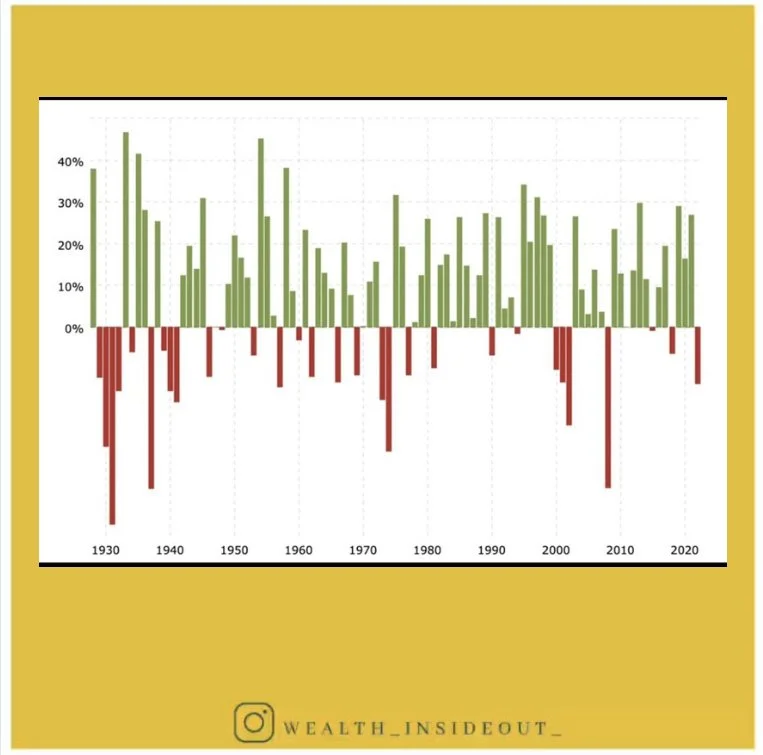

Below is a graph of the bull (green) and bear (red) markets. Being an advisor in 2008 was treacherous, it WAS NOT a fun time. People did pull out at the bottom, against professional advice, please note the growth that proceeded the downturn.

Keep you bum in the seat!